Crowdfunding Rapidly Coming of Age: $1.5Bil already and the Jobs Bill Hasn’t Even Taken Effect.

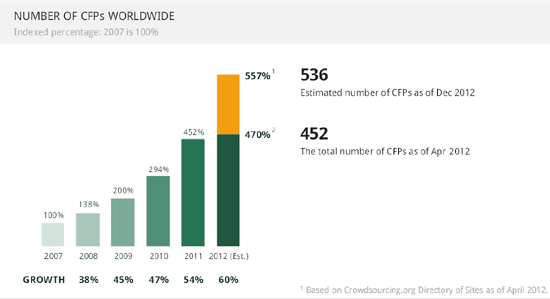

New research is out this week compiling crowdfunding in 2011- Massolution, a research firm that specializes in crowdsourcing and crowdfunding, published a first-ever  Crowdfunding Industry Report. Compiling data from more than 170 crowdfunding platforms (about 38 percent of the total number of platforms – WOW- if there are 450 platforms before the Jobs Bill, how many will there be once it takes effect?-), Massolution found that these portals raised $1.5 billion and successfully funded more than 1 million campaigns in 2011.

Crowdfunding Industry Report. Compiling data from more than 170 crowdfunding platforms (about 38 percent of the total number of platforms – WOW- if there are 450 platforms before the Jobs Bill, how many will there be once it takes effect?-), Massolution found that these portals raised $1.5 billion and successfully funded more than 1 million campaigns in 2011.

Almost the very day the Massolution report was announced, Pebble, that smartphone-connected watch we’ve recently discussed, grabbed headlines as 2012’s croudfunding poster child having ultimately raised $10million when the round closed this week. Recall, Pebble set out to raise $1ook! What’s interesting about Pebble’s fundraise is that because it was done through Kickstarter, it’s not an equity fundraise. Rather, ‘backers’ will get a shiny new pebble watch. In other words, Pebble took in $10mil in paid advance orders– a beautiful thing for New Market Entrepreneurs with a great idea and good design sense who happened to discover Kickstarter at just the right time.

Here is the link to a free exec summary of the Massolution report. The full-version will set you back a couple hundo after discounts. But there’s plenty to digest in the freebie:

- The types of crowdfunding plaforms are

- Equity-based

- Lending-based

- Reward-based (this is Kickstarter)

- Donation-based crowdfunding

- Equity-based and lending-based crowdfunding (i.e., for financial return) is most effective for digital goods (e.g.,software, film and music). These categories, on average, raised the largest sum of money per campaign

- Donation-based and reward-based crowdfunding for cause-based campaigns that appeal to funders’ personal beliefs perform best (e.g., environment)

- The primary revenue model for crowdfunding platforms is percentage based commission on funds paid out to entrepreneurs. A few also generate income by offering white label solutions and cash management by maintaining responsibility for netting and settlements.

- Growth has been and will continue to be staggering

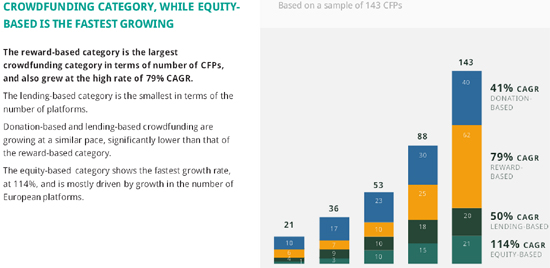

- Reward-based is the largest category in terms of overall number of CFPs, while equity-based is the fastest-growing category by net year-on-year growth. North America leads other regions in terms of the total number of crowdfunding platforms, however Europe is gaining percentage share within the market in aggregate. Here’s how they split out and are expected to grow:

- Growth in dollars raised will double this year.

Be sure to check out the entire (free) report here… there’s much more!

One of the most interesting elements in the report – at least for us- were the several slides listing Crowdsource Funding platforms. Most we had never heard of. We believe as 2012 comes to a close and the Jobs bill takes effect- and certainly by this time next year- we will see a handful of dominant platforms handling the lion’s share of the volume for each funding category. As in all early stage markets, there will be a consolidation to strength/market dominance. We believe this will be accelerated by the network effect. Fundraisers and investors will want to be where they perceive the most action is.

Perhaps this is already happening in the rewards space which is not as limited in a regulatory sense as the equity space and has been free to evolve more organically. Clearly, Kickstarter is ‘kicking it’. But there is still much room for improvement as suggested by this recent, thoughtful piece.

KICKSTARTER HAS UNCOVERED MANY UNTAPPED CONSUMER DREAMS. BUT THE MODEL NEEDS IMPROVEMENT BEFORE IT USHERS IN A HARDWARE RENAISSANCE, ARGUES FROG’S ROBERT FABRICANT. -read more-

We are excited to both observe and take part in the crowdfunding revolution in the coming months and years! What about you?

How many of the 540 sites out there are true crowdfunding donation/gift sites vs crowdfunding JobActs investment sites. I believe the donation sites are 99% of the 540 sites and will remain the majority of the sites vs. the investment sites. Why? Because the government, the SEC and VC’s will have to much influence on the process. Based on today’s negative attitude towards anything Wall Street, it doesn’t make sense for the crowd to get involved in the investment side. The soon to be released rules and regulations will be complicated and push people towards crowdfunding donation sites. Crowdfunding via donations is transparent, simple and self fraud policing.

Thanks for your thoughts! I’m on the hunt for a census that categorizes the sites based type (equity, lending, rewards, or donation). I agree. It will be interesting to see how it all shakes out, especially the JobsAct rules.